7 tips for a successful property investment in London

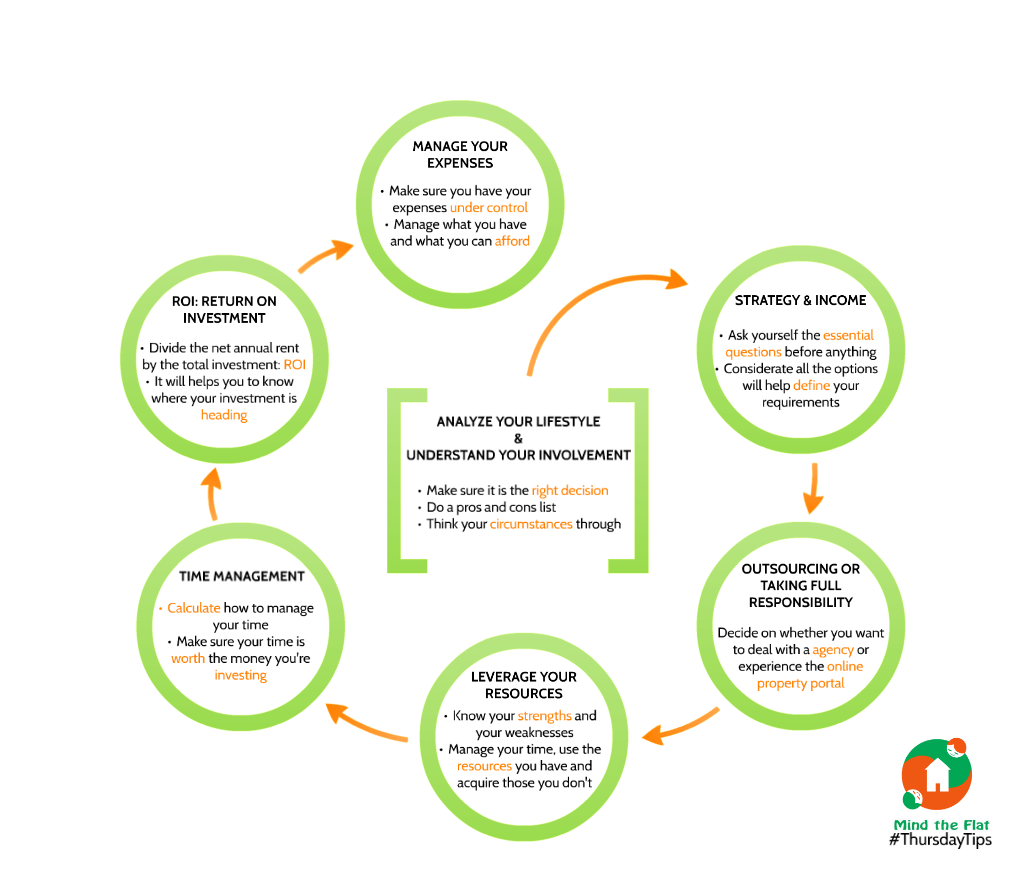

Despite its current growth and (extremely) profitable situation, successful property investment in London and becoming a landlord can be a risky business. Many property investors in London fail to reach their expectations and end up losing money due to the lack of strategy or proper planning at the time of jumping in the market. These 7 tips will show the right way and will support London property investors through their crucial decision-making process:

1) Analyze your lifestyle and understand your involvement

- :

Think your circumstances through. Don’t make a quick decision based on a friend’s opinion or the influence of the press. Think your situation through and analyze if this investment is going to be a full-time or just a partial thing in your life. This decision will affect all the other steps, so make sure it’s the right one.

2) Strategy and Income“What do you want to reach?” or “when do you want your profits to appear?” are essential questions to ask ourselves before jumping in investment. Shorter term profits will be accompanied with a higher initial investment whereas lower investments will allow us to prepare higher long-term profits. Having these aspects clear enables us to decide the type of the property we will invest in (houseshare, flatshare, a flat in London…), the area of London, the style and to which target will we market it to.

3) Outsourcing or taking full responsibilityOutsourcing to an agency is only a good solution if the time you have or you wish to spend (back to step 1) is limited since they charge a disproportionate amount. Decide whether you will want to put an extra effort in your property search and gain higher profits, or just have an agency manage for a high amount of your money. An online property portal can be of great help and can provide support if you decide you take full responsibility.

4) Leverage your resourcesKnow your strengths and your weaknesses. Taking full responsibility does not mean doing everything on your own. If you know you will be able to broker your property and find a good tenant with the time you have, hire a company to take care of the refurbishment (for example). Always manage your time, use the resources you have and acquire those you don’t.

5) Time managementCalculate how you manage your time by analyzing how long it takes you to do all the things you do. Make sure your time is worth the money you are taking in for it! If you spend too much time on something, you may want to outsource it.

6) ROI: Return on InvestmentDivide the net annual rent by the total investment, including council tax, certificates, refurbishment, etc. This will give you the ROI or the amount of money you are gaining in a percentage of your investment. Calculate this periodically to know where your investment is heading. You should be gaining approx. 10%.

7) Manage your expensesThere are two sides to property investing in London: it is either a profitable business which can be very beneficial for you and your family, or a terrible mistake that will cost you some of your well-earned pounds. Always make sure you have your expenses under control. Having a single, but profitable property is much better than having a portfolio of i.e. three properties where one of them is making you lose money.

Manage what you have and what you can afford and keep these two things at the same level to be a successful property investor in London.